In November 2018, the YFY Board of Directors approved the Sustainability and Social Responsibility Code, the Corporate Governance Code, and the Integrity Management Code. These guidelines address issues of integrity, governance, environment, and social responsibility, and are designed to guide both internal and external communication and compliance.

The company has established a dedicated unit, the "ESG Office," to drive the group’s sustainable development and oversee ESG projects. The ESG Office is primarily responsible for:

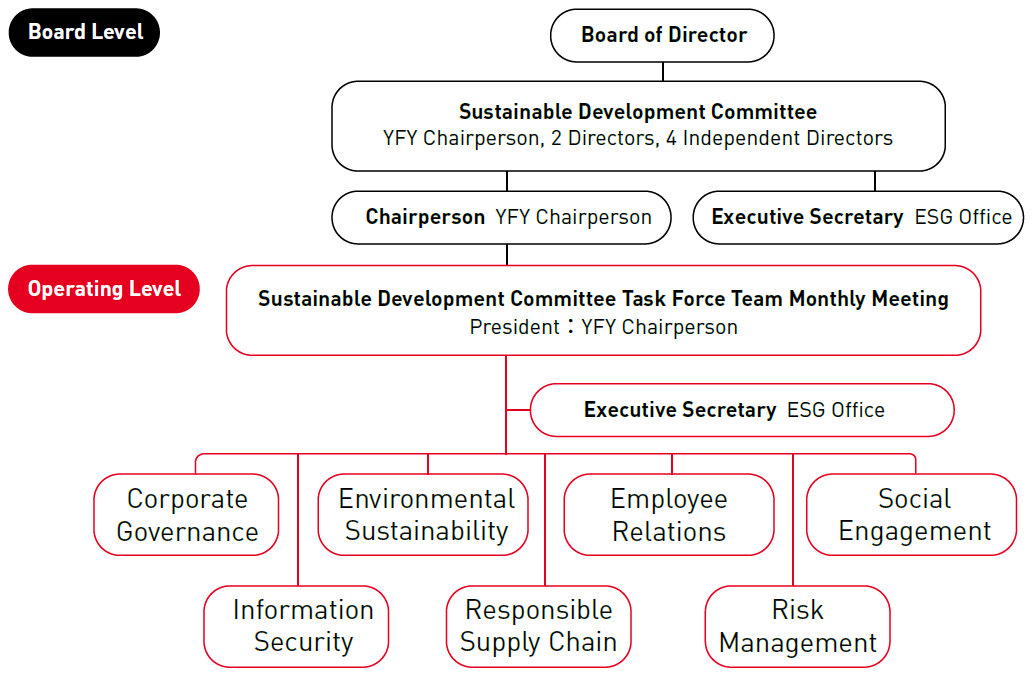

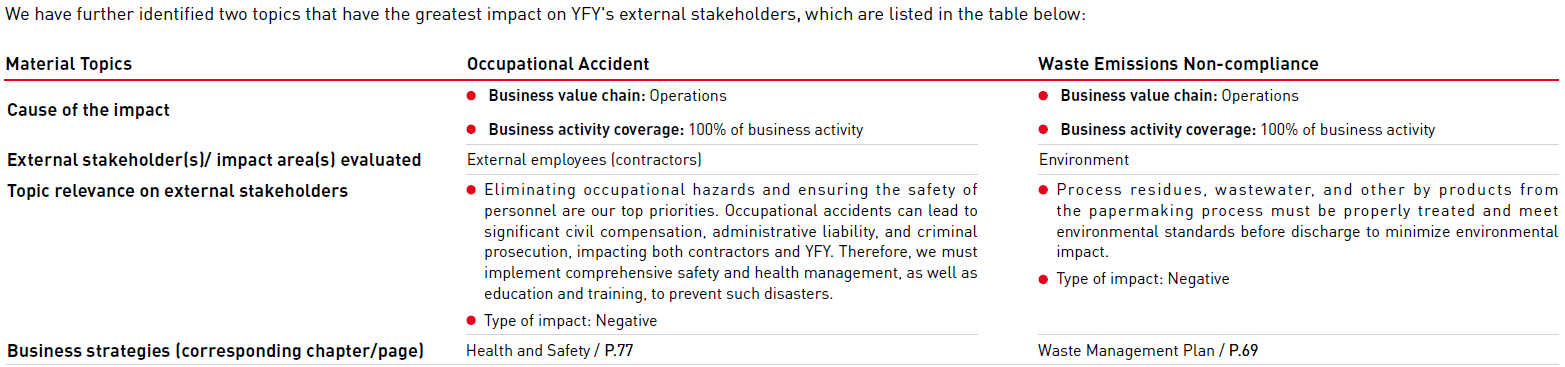

To further advance ESG initiatives, the company established a cross-business group, the "Sustainable Development Committee," in September 2021. The first committee meeting was held in May 2022, elevating ESG management to the board level and establishing it as a functional committee distinct from the statutory board. The committee is chaired by the YFY Chairperson and includes two directors, four independent directors, and the ESG Office serving as the executive secretary. The working groups hold ad hoc meetings and report to the Sustainable Development Committee at least twice a year. In 2023, the Sustainable Development Committee held two meetings with a 100% attendance rate.

Seven working groups have been established under the committee, led by senior department heads. These groups coordinate with members from the relevant functional departments and include the Corporate Governance Group, Environmental Sustainability Group, Employee Relations Group, Responsible Supply Chain Group, Social Participation Group, Information Security Group, and the newly formed Risk Management Group (established in 2023). They collaborate with the respective heads of each business group to advance risk assessment and internal management of environmental, social, and governance issues related to the company's operations, and to propose planned actions and target directions. For more details, please refer to Chapter [Materiality and Stakeholders].

YFY’s governance unit and senior management participate in annual ESG education, training, and forums. The aim is to integrate ESG into daily operations, enhance sustainability awareness and knowledge among all employees, and cultivate a culture of sustainability. Please refer to P.25 and P.35 of the annual report for more details. Additionally, the ESG office has organized various courses, including carbon inventory training for group subsidiaries, ESG capital expenditure briefings, and supply chain ESG internal training, to further deepen employees' sustainability awareness in their business activities.

To demonstrate its commitment to sustainable development, our company has closely linked ESG performance with the compensation of senior executives. For managers at the associate vice president level and above, at least 30% of their annual performance goals are tied to ESG-related metrics. This is designed to encourage senior management to actively drive improvements in the company’s performance in environmental protection, social responsibility, and corporate governance. To ensure objectivity and transparency in performance evaluations, we employ scientific and objective performance indicators that are closely aligned with the company’s overall sustainability strategy. The Sustainability Development Committee is tasked with overseeing the evaluation process to ensure fairness and professionalism.

In addition, we regularly conduct ESG-related training programs to enhance senior executives’ awareness and expertise in ESG topics, while also providing them with the necessary resources and support. The results of senior executives' annual performance evaluations directly influence their year-end bonuses, employee compensation, and promotion opportunities. This approach motivates them to incorporate ESG goals into their daily decision-making processes, advancing long-term sustainability objectives and creating shared value.

| Performance Indicators | Implementation (Weighting) | |

| CEO |

30% Sustainability and Internal Control Metrics |

Committed to fulfilling sustainability pledges, with emphasis on integrity in business operations, legal compliance, and risk control, while carrying out key ESG initiatives. Specific actions in corporate governance and risk management account for at least 10% of the total indicators. |

| Senior Executive | 30% Sustainability and Internal Control Metrics (Weightings may vary depending on managerial responsibilities) |

1.Corporate Governance 2. Information Security 3.Supply Chain Management 4. Health and Safety 5.Human Capital Development 6.Greenhouse Gas Emissions 7. Circular Economy 8. Energy Management 9.Water and Waste Management |

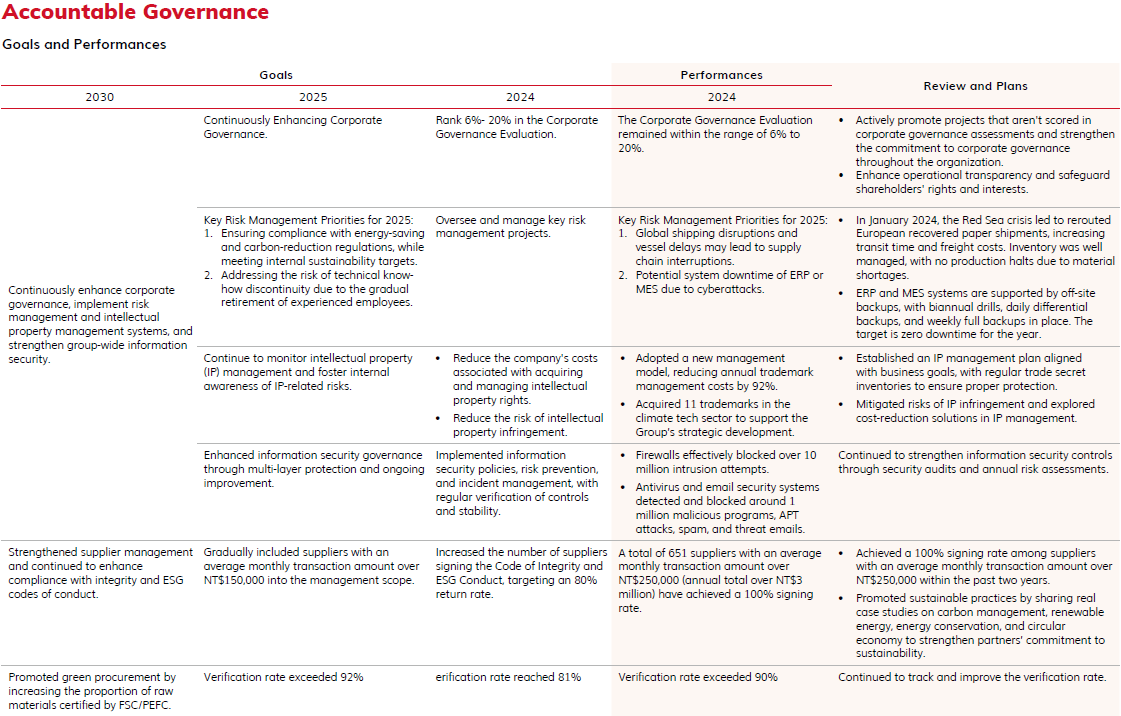

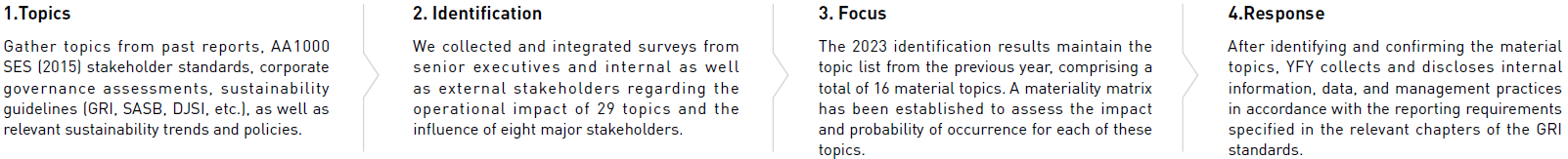

YFY identifies key material topics each year and submits them to the Sustainable Development Committee for approval. These topics guide our annual projects and stakeholder communications. YFY has established specialized communication channels for different stakeholders to address their needs and protect their rights and interests. Below are the details. In 2023, there were no appeal cases.

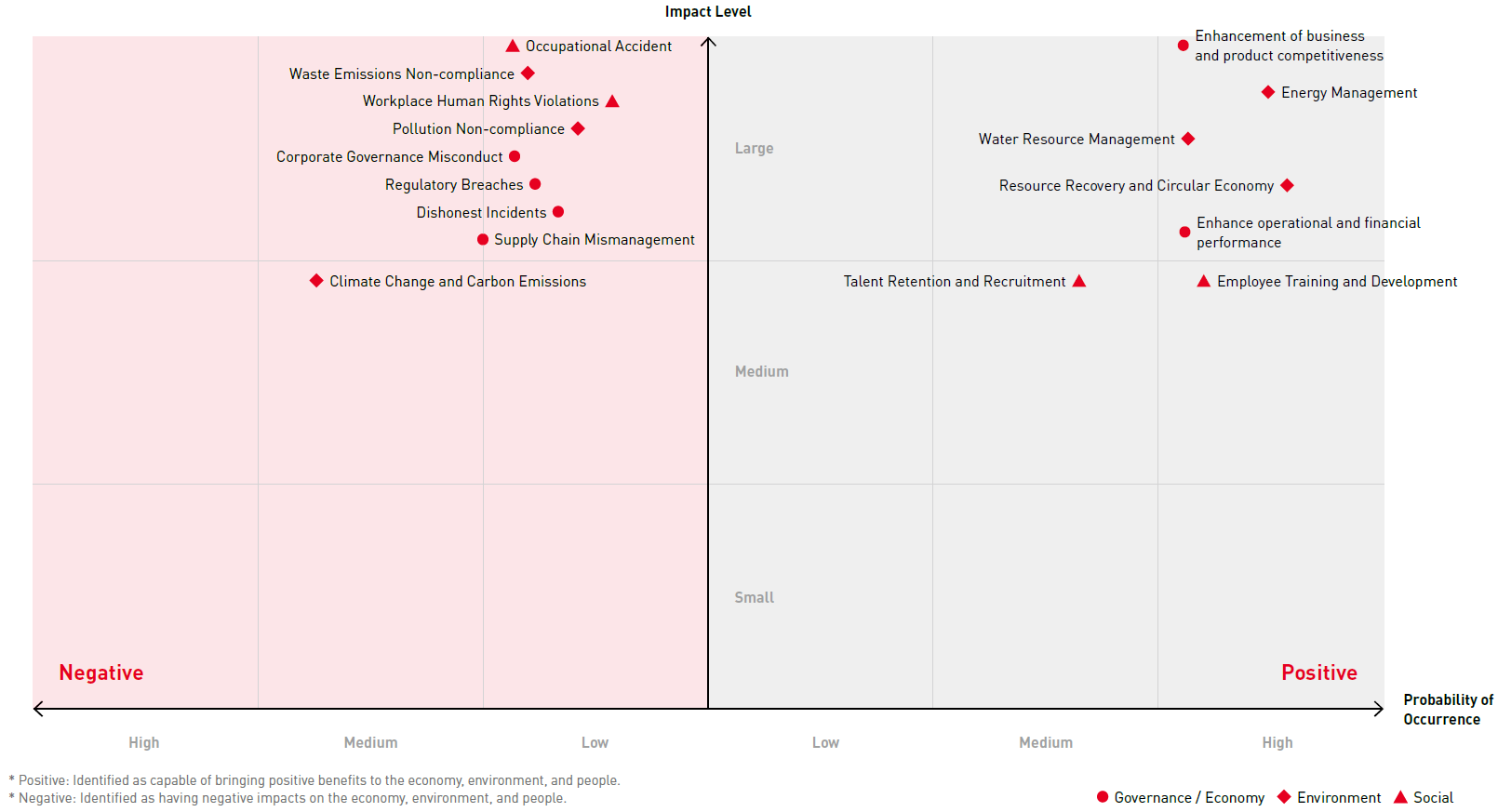

In 2023, among the 16 major themes identified, 6 are related to governance/economics, with 2 identified as having positive impacts. Additionally, three out of the 6 environmental themes are expected to bring positive benefits. Among the 4 social themes, 2 are anticipated to have positive impacts. Overall, the positive themes predominantly fall within the quadrant characterized by "medium-to-large impact and medium-to-high probability of occurrence." Conversely, the negative themes are mainly situated in the quadrant denoted by "medium-to-large impact but medium-to-low probability of occurrence."

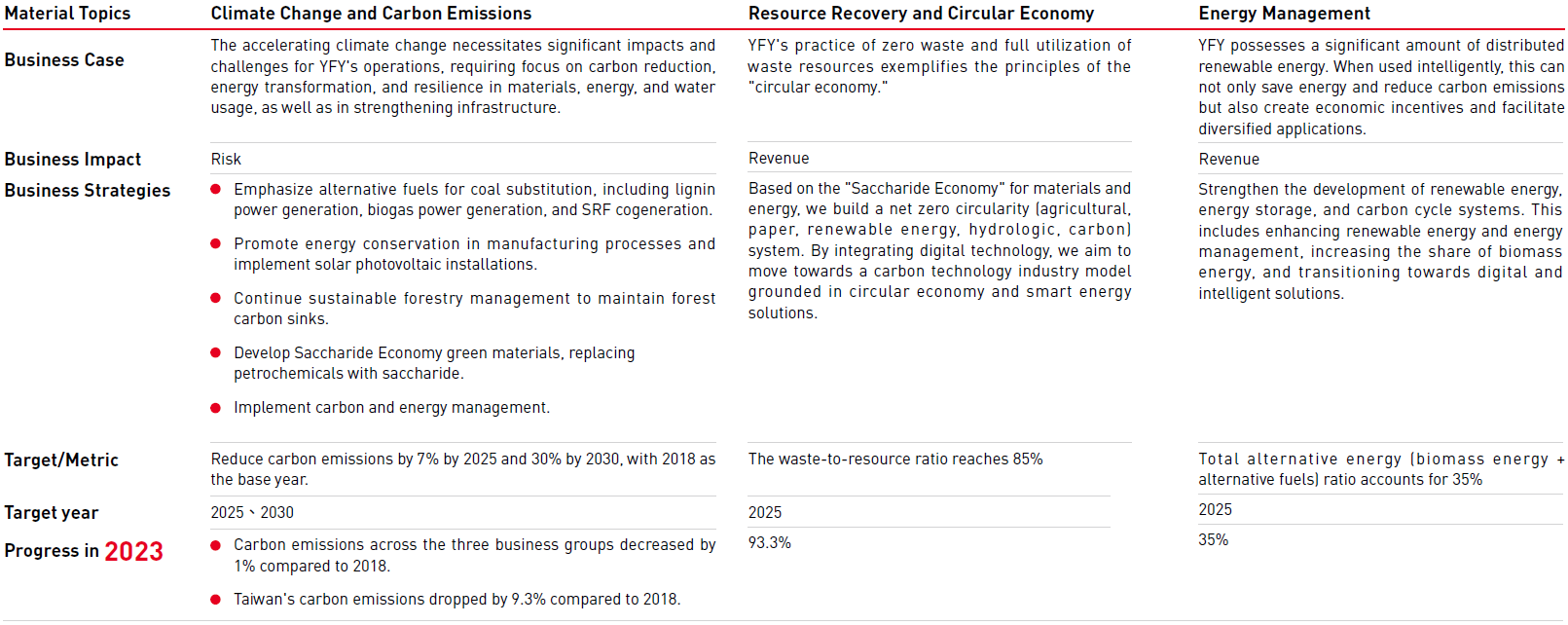

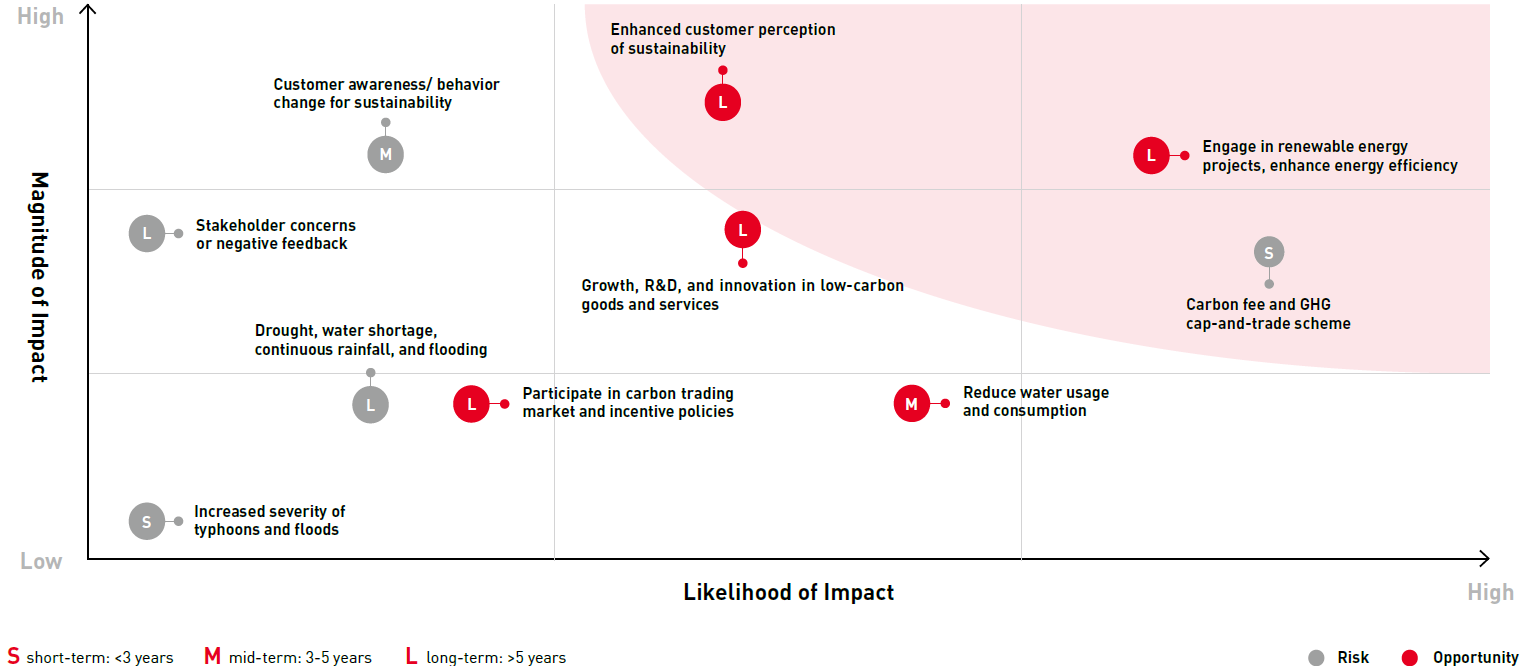

Based on the results of the materiality analysis, we have identified the three most important topics, objectives and progress for YFY, which are listed in the table below:

We have further identified two topics that have the greatest impact on YFY's external stakeholders, which are listed in the table below:

Responding to climate change and assessing its risks and opportunities is crucial for governments and businesses globally. Environmental risks, low-carbon alternatives, energy transition, and resource efficiency are vital for manufacturing. Since 2021, YFY has utilized TCFD's core elements to identify and analyze potential climate risks, and has actively implemented adaptation and mitigation actions to ensure the sustainability of its personnel, assets, and operations.

The Board of Directors has established a functional committee named the "Sustainable Development Committee," chaired by the YFY Chairperson and comprising two directors and four independent directors. Seven task force teams operate under this committee, meeting monthly. The chairperson leads the task force teams, guiding senior management in coordinating departmental efforts across the business group to promote operational and climate-related risk assessment and internal management.

The Environmental Sustainability team, led by the Chief Operating Officer, regularly reviews climate risks, opportunities, response strategies, and project implementation to align with goals. The newly formed Risk Management team, initiated in 2023, promotes the YFY's risk management and communicates with other task force teams in real time to accurately grasp risks across different areas, including market and industry, operations, environment (including climate), finance, raw materials, supply chain, legal compliance, and information security. In 2023, under the supervision of the Risk Management team and management, two risk training sessions were held. Risk authorities assessed 53 risks, discussing their impact and probability, and identified six medium- and high-risk issues. Among these, a climate transition risk was highlighted, where carbon fee payments increase operating costs.

In 2018, the Board of Directors approved the “Sustainability and Social Responsibility Code,” mandating that the company fully consider environmental impacts in its business activities. The company must also develop and implement energy conservation, carbon reduction, and greenhouse gas reduction strategies based on operational status and greenhouse gas inventory results to minimize the impact of business activities on climate change.

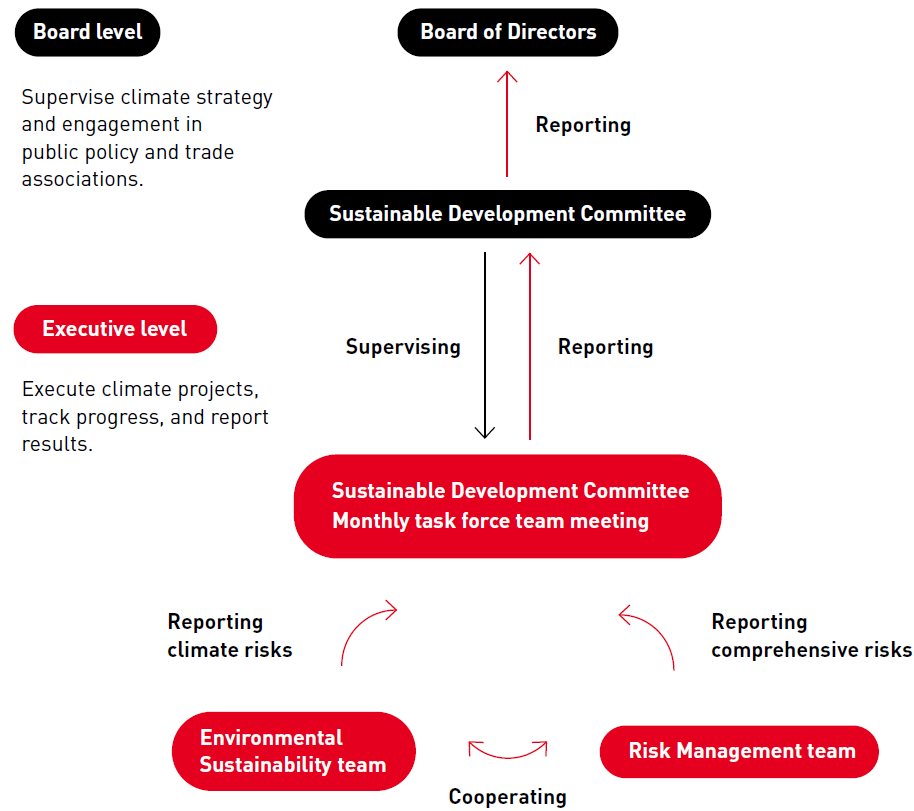

YFY integrates climate change issues into its business strategy, identifying short-, medium-, and long-term climate risks and opportunities and helping YFY understand the financial impact of climate change and plan effective response strategies.

We refer to international climate events and industry trends, domestic and foreign regulations, policies, research from authoritative institutions, and reports from peer companies to identify issues relevant to the paper industry. Through cross-business group discussions and workshops, we use the TCFD materiality methodology to rank the impact and likelihood of risks and opportunities. This process identifies major climate-related risks and opportunities in our operations, as shown in the matrix, with high-risk/opportunity issues in the upper right corner.

In line with the YFY's risk management process, risk identification is reviewed annually. The 2023 review maintains the previous year’s list, including three transition risks, two physical risks, and five opportunities. Following UN SDG guidelines for sustainable consumption and responsible production, YFY has adopted sustainable circularity as a key strategy. This includes using agricultural and forestry by-products as raw materials, recycling continuously, producing renewable paper and materials, and advancing initiatives in renewable energy, water management, and carbon management as part of our climate response actions.

Risk and Opportunity Matrix

Accordingly, we assess the potential short-, medium-, and long-term financial impacts of these 10 risks and opportunities and develop strategies and management plans to address them, as set out below.

Accordingly, we assess the potential short-, medium-, and long-term financial impacts of these 10 risks and opportunities and develop strategies and management plans to address them, as set out below.

Under the Sustainable Development Committee's structure, the Environmental Sustainability team regularly identifies climate risks and opportunities, while maintaining close communication with the Risk Management team to integrate major risks and opportunities into the company's overall risk management system.

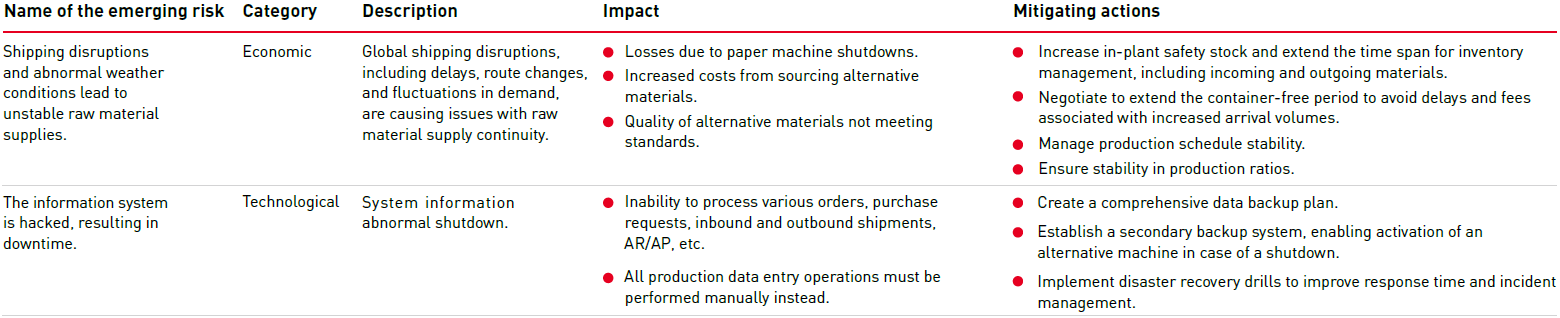

In 2023, the ESG Office, serving as the Executive Secretary of the Committee, delivered biannual reports on task force teams’ progress and outcomes, and the implementation progress of the energy conservation and carbon reduction plan for oversight and recommendations from the directors. At the end of the year, the Risk Management Team presented six medium- and high-risk issues and their countermeasures to the Committee, with the top two emerging risks selected by committee members. The task force team meeting will track the effectiveness of emerging risk management in late 2024 and report to the Committee and the Board.

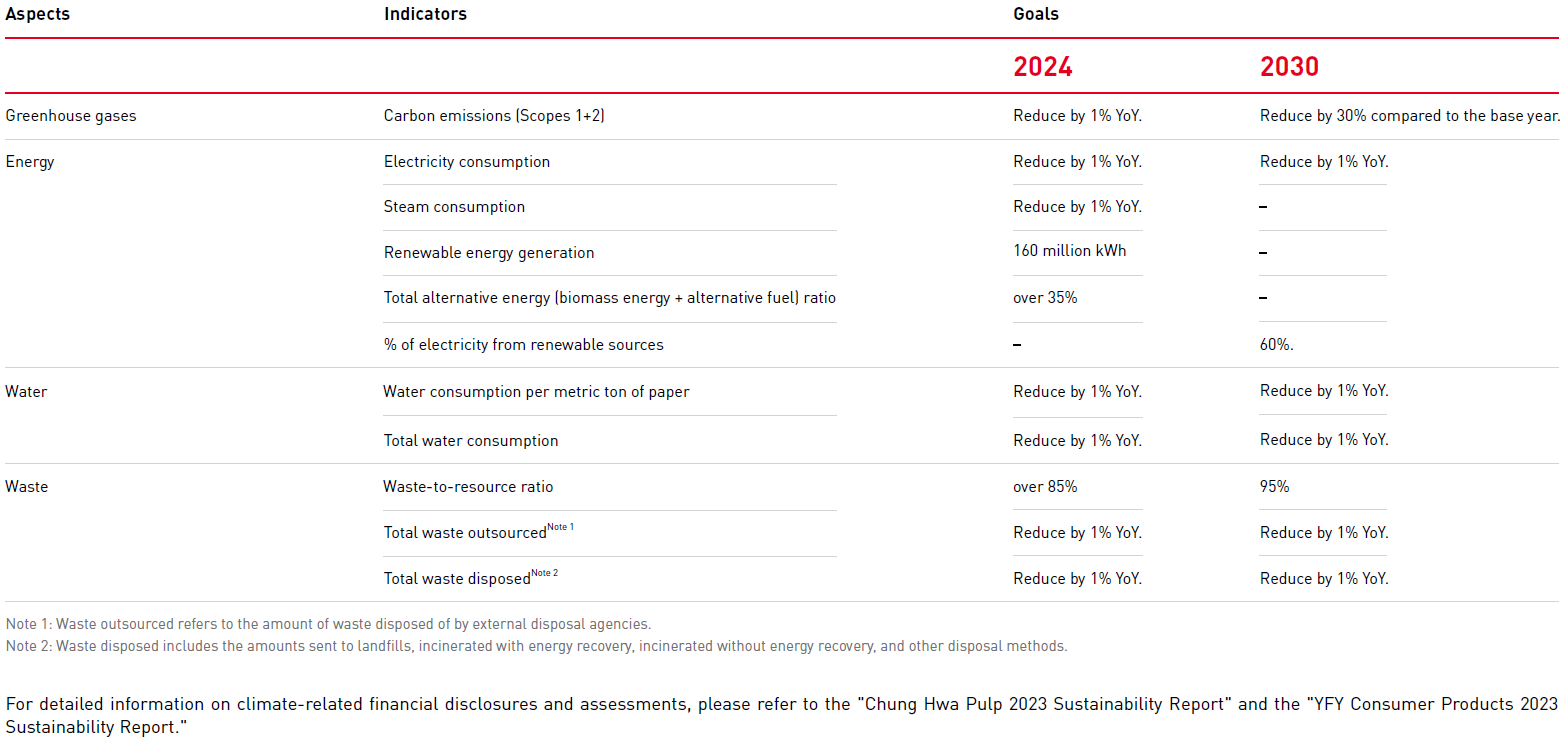

YFY continues to develop climate-related indicators for managing greenhouse gases, energy, water, and waste, advancing toward our net-zero goal. Currently, we do not use carbon offset credits or renewable energy certificates to meet these climate goals.

The company has established "Risk Management Policies and Procedures," with the Sustainability Development Committee overseeing risk management in accordance with these policies. This committee includes a risk management group responsible for driving risk identification and management across various areas, including finance, operations, information security, and legal compliance. We provide regular reports to the board of directors. On November 13, 2023, we presented the board with an overview of the risk management organizational structure, procedures, and operations. Additionally, on November 13, 2024, we reported on the operational performance for the current year. We will continue to develop, implement, and refine risk management strategies and monitor their effectiveness. For detailed information on the operation of our risk management policies and procedures, please refer to P.99-P.100 of the annual report.

Regarding risk assessment and response, after identifying 66 risks in 2024, the risk management team prioritized key risks for management and control in 2025. Then, the Sustainable Development Committee identified the top two emerging risks for further attention.

The company manages financial risks associated with its operations, which encompass market risks (including exchange rates, interest rates, and other prices), credit risks, and liquidity risks. The assessment also covers risks related to the Labor Standards Act pension system, such as investment, interest rate, and salary risks.

For detailed analysis, please refer to Appendix P.216, P.238~240, P.298 and P.308~310 of the 2023 Annual Report.

YFY manufactures recycled wood-based products—including paper, cardboard, and related materials—that are derived primarily from recovered fibers. By integrating recycled pulp into production, YFY reduces reliance on virgin timber while extending the lifecycle of wood resources. These products not only meet high performance and quality standards for printing, packaging, and consumer use but also contribute to circular economy goals by lowering carbon emissions, minimizing waste, and promoting responsible resource utilization across the value chain.

Unit: TWD

|

Revenues from: |

2021 | 2022 | 2023 | 2024 |

| Recycled wood-based products (paper, cardboard, etc.) | 37,246,135,680 | 36,700,986,384 | 34,665,483,952 | 35,032,359,075 |

| Percentage of sustainable revenues | 43.67% | 46.09% | 46.93% | 44.68% |

Unit: NT$ thousand

| Tax jurisdiction (country) | Resident entity name | Primary activities | Revenue |

| Taiwan(ROC) | Chung Hwa Pulp Corp. | Pulp and paper production, sale and afforestation operations. | 18,242,252 |

| Effion Enertech Co., Ltd. | Management of cogeneration, heat supply, and energy technology services. | 73,806 | |

| Ensilience Co., Ltd. | Renewable energy electricity sales industry and energy technology services industry. | 225,907 | |

| Ever Growing Agriculture Biotechnology Co., Ltd. | Manufacturing and wholesale of agricultural services, fertilizers and cleaning products. | 363,774 | |

| Fidelis IT Solutions Co., Ltd. | Wholesale and retail of information software, data processing, electronic information supply services and related equipment. | 175,783 | |

| Foong Chuan Green Energy Co., Ltd. | Wastewater treatment industry, resource recycling industry, and environmental testing services industry. | 171,154 | |

| Genovella Renewables Inc. | Fertilizer industry, food retail industry, cultivation industry, refractory material manufacturing industry, cement and concrete product manufacturing industry, building materials and refractory material wholesale and retail industry, refractory material retail industry, manpower dispatch industry, chemical raw material retail and wholesale industry. | 49,911 | |

| Hwa Fong Investment Co., Ltd. | General investment. | - | |

| LiVEBRiCKS Inc. | Information processing services. | 26,130 | |

| Pek Crown Paper Co., Ltd. | Production, trading and import.export of papers, cardboards, containers, and related materials. | 1,428,573 | |

| San Ying Enterprise Co., Ltd. | Engineering of various water treatment and design and construction of measurement facilities used in environmental pollution prevention engineering. | - | |

| Shin Foong Specialty and Applied Materials Co., Ltd. | Production and sales of latex and adhesives. | 1,706,196 | |

| Sustainable Carbohydrate Innovation Co., Ltd. | Research and development. | 34,867 | |

| Union Paper Corp. | Production, processing, and selling of paper products. | 1,879,033 | |

| YFY Biotech Management Company | Investment consulting | - | |

| YFY Consumer Products Co., Ltd. | Production and sales of paper, paper products and household cleaning products. | 7,362,950 | |

| YFY Corporate Advisory & Services Co., Ltd. | Management consulting services. | 191,737 | |

| YFY Development Corp. | Real estate investment and development. | 597,085 | |

| YFY Packaging Inc. | Production and sales of paper and paper products. | 11,485,728 | |

| YFY Paradigm Investment Co., Ltd. | General investment. | - | |

| Yuen Foong Shop Co., Ltd. | Wholesale retail industry. | 1,434,510 | |

| Yuen Yan Paper Co., Ltd. | Production, trade and import/export of corrugated boards and corrugated boxes. | - | |

| Subtotal for Taiwan | 45,449,396 | ||

| China | Arizon RFID Technology (Hong Kong) Co., Ltd. | RFID design, manufacturing and sales. | 1,256,082 |

| Arizon RFID Technology Co., Ltd. | Engaged in the design, development, manufacturing and after- sales service of various software and hardware of radio frequency intelligent identification systems (RFID), packaging and decoration printing. | 3,884,550 | |

| Guangdong Dingfung Pulp & Paper Co., Ltd. | Production and marketing of pulp, writing.printing paper, and dowling paper. | 2,356,047 | |

| Guizhou Yuan Fung Forestry Co., Ltd. | Cultivation and sales of seedlings, afforestation, logging and other forestry and sales, processing and transportation of forest trees. | - | |

| Hwa Fong Paper (Hong Kong) Co., Ltd. | Trading, printing and sales of all types of paper products; paperrelated businesses. | - | |

| Jupiter Prestige Group Asia Ltd. | Graphic design. | 235,770 | |

| Jupiter Supply Chain Management Services (Shenzhen) Co. | Packaging design and paper trading. | - | |

| Kunshan YFY Jupiter Green Packing Ltd. | Packaging design and paper trading. | 602,020 | |

| Mobius105 Ltd. | General investment, packaging design and paper trading. | 121,477 | |

| Shenzhen Jinglun Paper Co., Ltd. | Sales of paper products and cargo and technology imports.exports. | 2,228,066 | |

| Syntax Communication (H.K.) Ltd. | Trading, printing and sales of all types of paper products; paper- related businesses. | 16,292 | |

| Winsong Packaging Investment Company Ltd. | General investment. | - | |

| YFY Investment Co., Ltd. | General investment and trading of paper products. | 5,049,940 | |

| YFY Jupiter Limited | Packaging design and paper trading. | 1,058,263 | |

| YFY Jupiter Trading (Shenzhen) Ltd. | Packaging design and paper trading. | 606,532 | |

| YFY Packaging (Yangzhou) Investment Co., Ltd. | General investment, paper products and trading of paper products. | 6,760,650 | |

| YFY RFID Co. Limited | General investment. | - | |

| Yongfeng Yu Paper (Kunshan) Company | Production, printing and sales of all types of paperboard and cardboard boxes. | 390,145 | |

| Yuen Foong Shop (Hong Kong) Co., Ltd. | International trade and selling of household products. | - | |

| Yuen Foong Yu Blue Economy Natural Resource (Yangzhou) Co., Ltd. | Development of agricultural recycling and production technologies and related consulting and services. | - | |

| Yuen Foong Yu Consumer Products (Yangzhou) Co., Ltd. | Production and sales of toilet paper, paper towels and napkins. | 2,677,866 | |

| Yuen Foong Yu Family Care (Kunshan) Co., Ltd. | Production and sales of toilet paper, paper towels and napkins. | 665,571 | |

| Yuen Foong Yu Paper Enterprise (Dongguan) Co., Ltd. | Production, printing and sales of all types of paperboard and cardboard boxes | 664,647 | |

| Yuen Foong Yu Paper Enterprise (Fuzhou) Co., Ltd. | Production, printing and sales of all types of paperboard and cardboard boxes. | 106,320 | |

| Yuen Foong Yu Paper Enterprise (Nanjing) Co., Ltd. | Production, printing and sales of all types of paperboard and cardboard boxes | 933,277 | |

| Yuen Foong Yu Paper Enterprise (Qingdao) Co., Ltd. | Production, printing and sales of all types of paperboard and cardboard boxes | 740,512 | |

| Yuen Foong Yu Paper Enterprise (Shanghai) Co., Ltd. | Production, printing and sales of all types of paperboard and cardboard boxes. | 751,677 | |

| Yuen Foong Yu Paper Enterprise (Suzhou) Co., Ltd. | Production, printing and sales of all types of paperboard and cardboard boxes. | 601,957 | |

| Yuen Foong Yu Paper Enterprise (Tianjin) Co., Ltd. | Production, printing and sales of all types of paperboard and cardboard boxes. | 688,370 | |

| Yuen Foong Yu Paper Enterprise (Zhongshan) Co., Ltd. | Production, printing and sales of all types of paperboard and cardboard boxes | 746,504 | |

| Yuen Foong Yu Paper MFG (Yangzhou) Co., Ltd. | Production sales of all types of paper and paperboard. | 9,551,471 | |

| Yuen Foong Yu Papers (Guangzhou) Co., Ltd. | Production, printing and sales of all types of paperboard and cardboard boxes. | 1,356,055 | |

| Yuen Foong Yu Papers (Jiaxin) Co., Ltd. | Production, printing and sales of all types of paperboard and cardboard boxes. | 340,589 | |

| Yuen Foong Yu Papers (Xiamen) Co., Ltd. | Production, printing and sales of all types of paperboard and cardboard boxes. | 494,331 | |

| Yuen Foong Yu Papers Enterprise (Guangzhou) Co., Ltd. | Production, printing and sales of all types of paperboard and cardboard boxes | 1,356,055 | |

| Yuen Foong Yu Papers Enterprise (Xiamen) Co., Ltd. | Production, printing and sales of all types of paperboard and cardboard boxes. | 494,331 | |

| Zhaoqing Dingfung Forestry Co., Ltd. | Production and sales of non-long fiber pulp, long fiber pulp, writing and printing paper, and woodfree paper. | 479,503 | |

| Zhaoqing Xinchuan Green Technology Co., Ltd. | Environmental equipment technology research and development; construction of wastewater, flue gas, noise and solid waste treatment; pure water treatment construction; environmental technology consulting; sale of environmental protection equipment and chemical raw material; import and export of cargo and technology. | 47,480 | |

| Subtotal for China | 47,262,350 | ||

| Vietnam | Arizon Technology (Vietnam) Co., Ltd. | RFID design, manufacture and sales. | - |

| Jupiter Vietnam Company Limited | Packaging design paper sales. | 551,945 | |

| YFY Packaging (Ha Nam) Co., Ltd. | Manufacturing, printing and sales of various paperboards and cartons. | 2,149,794 | |

| YFY Packaging (Quang Ngai) Co., Ltd. | Manufacturing and sales of paperboard and cartons. | - | |

| YFY Packaging Thai Binh Co., Ltd. | Manufacturing, printing and sales of various cartons. | 700,178 | |

| Yuen Foong Yu Paper Enterprise (Dong Nai) Co., Ltd. | Manufacturing, printing and sales of various paperboards and cartons. | 1,991,558 | |

| Yuen Foong Yu Paper Enterprise (Vietnam) Binh Chanh Co., Ltd. | Manufacturing, printing and sales of various cartons. | 383,278 | |

| Yuen Foong Yu Paper Enterprise (Vietnam) Binh Duong Co., Ltd. | Manufacturing, printing and sales of various paperboards and cartons. | 1,872,293 | |

| Yuen Foong Yu Paper Enterprise (Vietnam) Co., Ltd. | Production, printing and sales of all types of paperboard and cardboard boxes | 2,020,371 | |

| Subtotal for Vietnam | 9,669,417 | ||

| Australia | Jupiter Prestige Group Australia Pty Ltd. | Graphic design. | 110,279 |

| British Virgin Islands | YFY RFID Technologies Co., Ltd. | General investment. | - |

| CHP International (BVI) Corporation | General investment. | - | |

| Willpower Industries Limited | General investment. | - | |

| YFY Biopulp Technology Limited | General investment. | - | |

| Cayman Islands | Arizon RFID Technology (Cayman) Co., Ltd. | General investment. | - |

| YFY Cayman Co., Ltd. | General investment. | - | |

| YFY Jupiter (Cayman Islands) Co., Ltd. | General investment. | - | |

| India | China Color Printing Co., Ltd. | Printing, photography, board making, binding and planning and design services. | 412,019 |

| Opal BPM India Private Limited | System process coding. | - | |

| Subtotal for India | 412,019 | ||

| Indonesia | YFY Jupiter Indonesia, PT PMA | Package design. | 724,966 |

| Japan | Arizon Japan Co., Ltd. | Product distribution and technical consulting services. | 37,769 |

| YFY Japan Co., Ltd. | Import and export of paper and related chemical materials; trading of related equipment. | 551,798 | |

| Subtotal for Japan | 589,567 | ||

| Malaysia | Shin Foong Trading Sdn. Bhd. | Trading of synthetic rubber emulsion and industrial chemical products. | 2,569 |

| YFY Jupiter Malaysia Sdn. Bhd. | Packaging design paper sales. | 238,167 | |

| Subtotal for Malaysia | 240,736 | ||

| Mauritius | YFY Mauritius Corp. | General investment. | - |

| Mexico | YFY Jupiter Mexico, S. de R.L. | Packaging design paper sales. | 338,725 |

| Netherlands | YFY Global Investment B.V. | General investment. | - |

| YFY International B.V. | General investment. | - | |

| Samoa | Yuen Foong Yu Consumer Products Investment Limited | General investment. | - |

| Thailand | YFY Jupiter (Thailand) Co., Ltd. | Package design. | 95,623 |

| United Kingdom | JPG CONTRAST UK LIMITED | Graphic design. | 78,281 |

| Jupiter Prestige Group Europe Limited | Graphic design. | 131,087 | |

| Jupiter Prestige Group Holdings Limited | General investment. | 23,539 | |

| Opal BPM Consulting Limited | System-related consulting services. | - | |

| Opal BPM Limited | Process system design and support. | 92,411 | |

| Subtotal for UK | 325,318 | ||

| USA | Arizon Corporation | Product distribution and technical consulting services. | 972,037 |

| Contrast LLC | Brand design. | 76,230 | |

| Jupiter Prestige Group North America Inc. | Packaging design and paper trading. | 108,501 | |

| YFY Consumer Products, Co. | IP management and sale of consumer products by e-commerce. | - | |

| YFY Jupiter US, Inc. | Packaging design and paper trading. | 558,650 | |

| Subtotal for USA | 1,715,418 |

Our company’s information security risk strategy is centered on leveraging technology and strengthening cybersecurity governance. Through a professional IT management and technical service platform, we ensure clear division of responsibilities, sufficient technical support, and robust control mechanisms across the company and its affiliates.

To comply with government regulations and enhance our cybersecurity governance, a dedicated Information Security Management Unit was established in November 2022. This unit is led by a Chief Information Security Officer (CISO) and is equipped with appropriate human, material, and financial resources. It includes a designated head of information security and two specialized personnel, tasked with implementing, supervising, and reviewing cybersecurity management practices. Starting in 2023, monthly information security meetings have been held, totaling 12 sessions annually. The unit operates under the direct supervision of the Chairman, who reviews the company’s cybersecurity policies and objectives at least once per year. Internal security audits and assessments are conducted regularly, with concrete management plans proposed and reported to the Board of Directors. Potential risks are assessed and addressed through strategic planning.

In line with the company’s operational management protocols, annual system disaster recovery drills and simulation exercises are conducted. Any identified deficiencies or suggestions are promptly addressed. The company also undergoes periodic inspections and verification by internal and external third-party audit units.

To further strengthen information security management, the company has obtained the CompTIA Security+ international certification. In 2023, we established the Information Security Control Guidelines, which serve as the company’s highest-level cybersecurity policy. These guidelines include key aspects such as security policy enforcement, protective controls, outsourcing management measures, system risk assessment and maintenance, incident response and reporting, and performance management mechanisms. All policies have been approved by the Board of Directors. Notably, no cybersecurity incidents occurred this year that could harm the company’s reputation, customer relationships, or revenue.

Through the interaction and checks and balances between humans and machines, software and hardware, an information security management network is constructed. Various established policies are implemented through this network: